Greek Shipping: A Strategic Sector for the European Economy

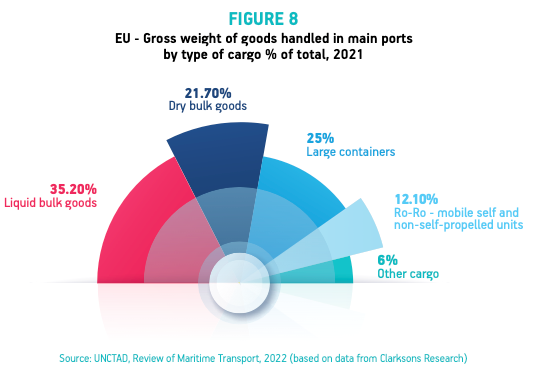

Shipping transports more than 72% of the EU's external trade. For many categories of basic food products, energy and raw materials, more than 80% of the total extra-EU trade volume is transported by sea- such as rice (90%), cereals (86%), fertilizers (86%), coffee, tea and spices (83%), animal or vegetable fats and oils (83%), man-made staple fibers (83%), while for certain ores more than 97% of volumes is transported by sea (nickel, aluminum and copper ores)4. Similar to the global trade, the products related to the bulk/tramp sector constitute the largest share of the volumes handled at EU ports (Figure 8).

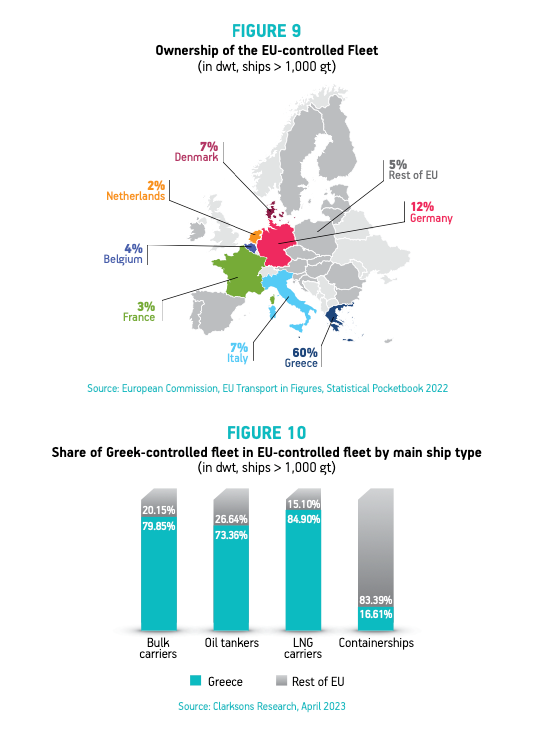

Greek shipping is the fundamental pillar of European shipping as it accounts for 60% of the EU-controlled fleet (Figure 9). For the most strategic ship type categories, Greek shipowners control more than 70% of the total capacity of the EU-controlled fleet (Figure 10), guaranteeing the supply of the essential goods and critical materials to the EU. In particular, Greek shipowners control 80% of the EU-controlled bulk carriers, 73% of the EU-controlled oil tankers, 85% of the EU-controlled LNG carriers and 17% of the EU-controlled containerships. More than 1/3 of the Greek-owned fleet flies an EU Member State flag, thereby further supporting the sector’s added value to the EU economy.

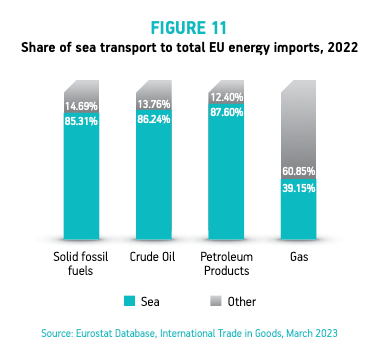

Greek shipping plays a key role in ensuring the uninterrupted supply of energy products to European countries. The EU Member States almost exclusively rely on imports for their oil and natural gas needs. Specifically, the EU imports 91.7% of its oil and petroleum products needs, 83.4% of its natural gas needs and 37.5% of its solid fossil fuels needs5, with the largest part of these quantities being transported by sea (Figure 11). Imported energy by sea is expected to rise even further during the next years as the EU policy (e.g. RePowerEU / Green Deal Industrial Plan) seeks to diversify energy sources to the EU in light of geopolitical conflicts and rivalries.

At the same time, the recent EU initiative Green Deal Industrial Plan (GDIP) aims to make Europe a hub of green products and new technologies. Its success will rely to a large extent on the performance of the shipping sector to enhance the resilience of supply chains and secure the uninhibited flow of Critical Raw Materials - 90% of which are already transported by sea6 - and other essential inputs for the European economy. Vessels will also transport the largest part of the new green products and alternative fuels around the world.

Greek shipping plays a key role in ensuring the uninterrupted supply of energy and other staple products to the European Union.

In addition, Short Sea Shipping (SSS) plays an important role in securing trade flows both intra-EU and between EU Member States and neighbouring third countries. It is estimated that 1.8 billion tonnes of goods were transported by SSS in 20217, almost 100 million tonnes more than the year before. The largest part comprises liquid bulk goods (40% of total), followed by dry bulk goods (21%), large containers (17%) and Ro-Ro units (15%). Regarding sea regions of partner ports, 35% is located in the Mediterranean Sea, 24% in the Baltic and 24% in the North Sea. SSS is one of the most environmentally friendly modes of transport, allowing the decongestion of roads. Thus, its competitiveness must be safeguarded to ensure that no modal shift takes place to the detriment of the EU environmental strategy.

Greek shipowners control 80% of the EU-controlled bulk carriers, 73% of oil tankers, 85% of LNG carriers and 17% of the EU-controlled containerships.

4. Eurostat Database, International Trade in Goods, March 2023

5. Eurostat Database, Energy Balances, March 2023

6. Eurostat Database, International Trade in Goods, March 2023

7. Eurostat Database, Maritime Transport, February 2023