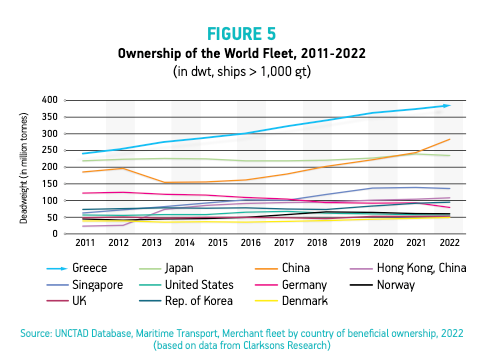

Features of the Greek-owned Fleet

Greece is the largest shipowning nation in the world (Figure 5), as Greek shipowners control the highest share, 21%, of the global merchant fleet in terms of deadweight tonnes - dwt3. During the last ten years the total capacity of the Greek merchant fleet, currently consisting of 5,520 ships, has grown by 50%.

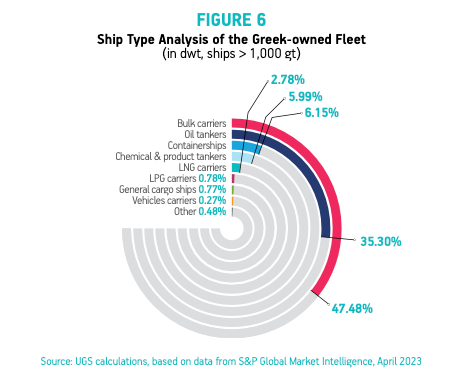

Greek shipping is the main facilitator of the transport of essential goods accounting for (in terms of dwt):

- 31.27% of the world oil tanker fleet

- 25.32% of the world bulk carriers

- 22.65% of the world Liquefied Natural Gas (LNG) carriers

- 15.79% of the world chemical & product tankers

- 11.46% of the world Liquified Petroleum Gas (LPG) carriers

- 8.92% of the world containerships

The Greek-owned merchant fleet is the world’s largest cross-trader. It transports cargoes between third countries with more than 98% of its fleet capacity. Greek shipowners are mostly active in bulk/tramp shipping (Figure 6), the segment of the industry that specialises in the carrying of staples, such as grain and other agricultural products, oil and gas, iron ore, chemical products, coal, fertilizers and forest products. Bulk/tramp shipping has the features of an almost perfectly competitive market and shipowners are price-takers.

The economies of the business mean that transport is provided in the most cost- effective and efficient way. For example, through ever-increasing economies of scale, transport costs are kept strikingly low to the benefit of the end consumer. Greek shipping has been a frontrunner in this respect, too. An average Greek-owned vessel is almost twice as big as the average vessel at global level. In particular, during the previous decade, the average size of Greek-owned ships has significantly increased, standing today at 81,395 dwt, while the world average remains far below, at 45,337 dwt.

Indeed, the growth of global seaborne trade during the last decades has not been accompanied by a similar growth in transport costs, thus contributing to the improvement of living standards globally.

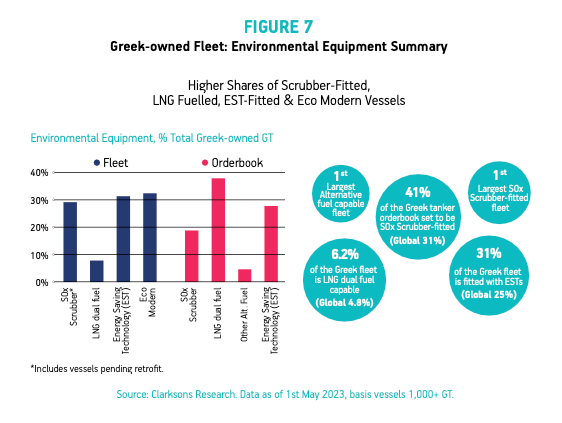

Greek shipowners do not only utilise significant economies of scale but they continue to invest heavily in new-build vessels and equipment of high environmental performance (Figure 7). They currently (April 2023) have 241 ships on order, corresponding to 19 million dwt. This represents a significant increase of 40% compared to the previous year’s orderbook (173 ships), attesting to the Greek shipping sector being the frontrunner also in fleet renewal. It is estimated that more than 40% of oil tankers and almost one out of 6 LNG carriers being built today will be delivered to Greek shipowners. Moreover, the average age of the Greek-owned fleet, around 10 years, is lower than the global average, almost 11 years.

Greek shipowners are at the forefront of new investments and innovations in the sector with a modern and environmentally friendly fleet.

3. UGS calculations, based on data from S&P Global Market Intelligence, April 2023